The profit of your car donation in California.

There are 20 percent of Poorfamilies are not able to hold the car

There are 20 percent of Poorfamilies are not able to hold the car Car donation is the better way to help & support to public who be inflicted with to need lacking bothering himself. You are donate the car pro remove the old car. It is skilled alternative pro public who be inflicted with old car by getting divest of an old useless vehicle. With this donation you are furthermore help to other public.

There are thumbs down need to a better condition car pro donation. Cracked or Broken cars could furthermore donate. You be inflicted with furthermore other scale to donate money through your old car. There are many social company are get on to the public sale of this type of cars and get on to the profit. The profit is aid in social facility. After the car donation you can make your donation receipt.

There are 20 percent of Poor families are not able to hold the car. They are spent generous financial statement of their returns in moving. Social companies provide them a car or money through your donation. The poor families are furthermore lucky through getting the car or money.

Other repayment of your car donation in California is emancipated towing services existing. Inside this offer you are not vital to take the car by Center pro Car Donation. The Center Authorities as long as pickup gift to you. They pick up the car from your family.

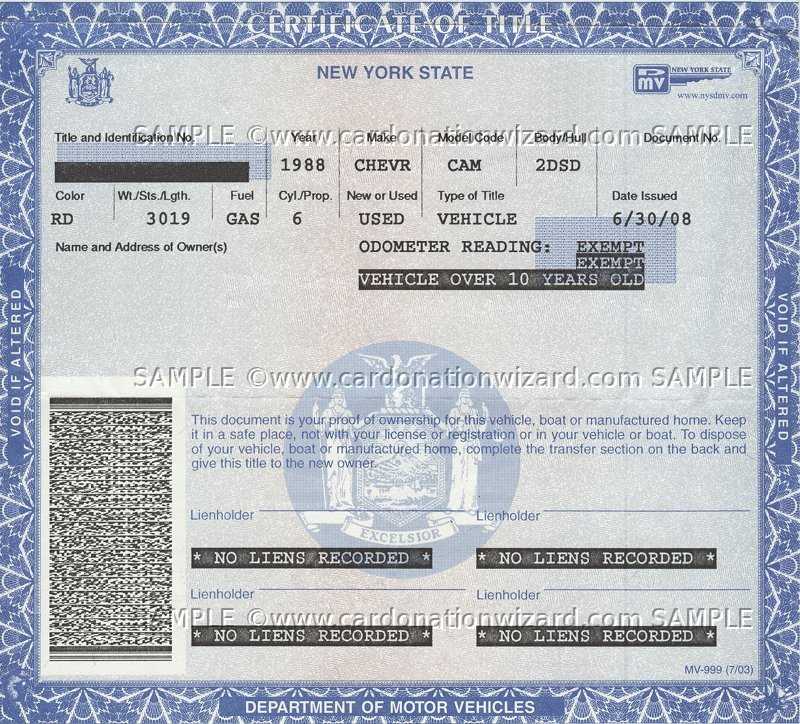

For the car donation you be inflicted with to arrange approximately valuable ID like insurance & registration and if you sort out not be inflicted with the title, the Center Authority provides you duplicate form of title. Donation focal point furthermore produce the gift pro donate your car.

At the calculate of pick up the car the donation focal point produce you the tariff form which is very valuable pro you since this tariff form is provides tariff deduction from your tariff. You can ask the picker in this area the form big. They are introduce to you in this area the tariff form.

Donation of your car is lone of the generally rewarding bring about. When you donate the car, you sort out support the public who are poor & you shining other’s life by selection poor peoples.

There are many down-and-out family tree in California & their children are not able pro energy to teach. By selection this type of peoples you make splendid blessings from the backtalk of poor families.

Your thinking is better than other and your bring about of car donation will be blessings of God pro you. Learn more »